Moving towards connected banking

Banking as a service, has always been recognized as an essential service by customers, who have continued to make commensurate demands of service providers. But the same customers have considered banking procedures as extensive and time-consuming. And they were right to some extent.

From opening a bank account to doing a transaction involved several manual processes and was limited to a physical bank branch. But all this took an amazing turn with onset of digitization of the financial services and overall banking industry. Now, new-age retail or corporate customers can do banking at their fingertips via multiple platforms and not just from the bank’s application.

Connected banking at Axis Bank is a platform that addresses your vendors’ inquiries, enables their transactions and helps with the automated reconciliation of your accounting entriesour vendors ries and transactions . It has broadened the horizon for customers and organizations by offering them the ease of availing financial services with the comfort of their preferred Application / ERP. Connected banking has also widened the scope for banks by increasing the market penetration to reach more and more people using multiple partner platforms.

Let’s understand with an example, earlier if a corporate had to disburse employee salaries, they would require to go through tedious manual process for document submissions, at the branch, to process the transaction. With the advent of connected banking, this can be automated through the corporate’s ERP system. This bridging of multiple corporate users enjoying hassle-free banking via their preferred ERP solution provider, is made possible by connected banking solution.

Connected Banking – Rapid responses to changing customer needs

Connected banking revolutionizes the traditional banking model by creating a more interconnected, customer-centric, and digitised ecosystem. Some of the important characteristics of connected banking are as follows:-

-

Connected banking enables real-time transaction processing and instant notifications which provides customers with latest information and status of their financial undertakings

-

Connected banking operates under strict regulatory frameworks to ensure data privacy, security and customer protection. It also allows secure data sharing

-

The seamless integration of financial services enhances user experience making the involvement more user friendly

-

It allows customers to view and manage multiple financial accounts through a single platform, thereby enabling account aggregation.

-

By aggregating financial figures, connected banking allows customers personalized insights and financial analytics

-

It encourages collaboration between traditional financial institutions and fintech. This fosters innovation in the financial industry

-

Connected banking has the potential to expand financial inclusion by making financial facilities more accessible

-

Through Open APIs, connected banking platforms can integrate with third-party financial services and fintech applications which also bolsters the range of existing services

Connected Banking vs. Open Banking

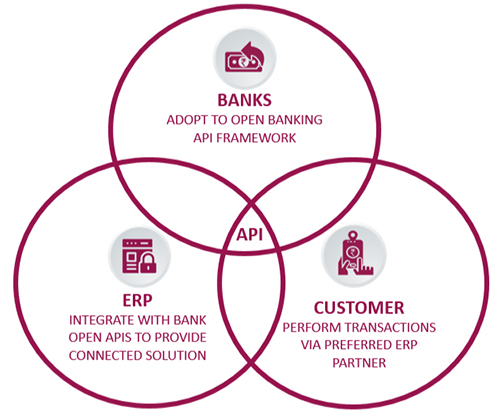

Open banking is a regulatory system that allows financial institutions to share customer financial data securely with third party providers through APIs.

With open banking, customers are offered better financial transparency, instant payments and optimized banking experience. On the flip side, the bank’s security and compliance teams need to conduct continuous reviews to ensure latest practices/guidelines are adhered to, by all backend applications.

Connected banking involves consuming open APIs, with seamless integration of various financial services and products into a single platform, with customer consent. It encourages industry players to collaborate with customers with faster time-to-market and drive higher adoption.

Related Topics

Mock API Environment – Game changer in API testing

API mocking refers to creating an environment that mimics the behaviour of an API. Any user can create applications and then test in sandbox environment without having access to actual data or endpoints.

Trends that are Shaping Payments in India

Remember when pocket money used to be in the form of coins and you owned a piggy-bank? Or when your parents handed you cash for college?

How Digital Banking is Disrupting the Banking Industry

Until the 90s, traditional banking remained largely unchallenged. But the advent of internet transmuted the banking industry to the ever-evolving landscape