CKYC - FD 15 APIs

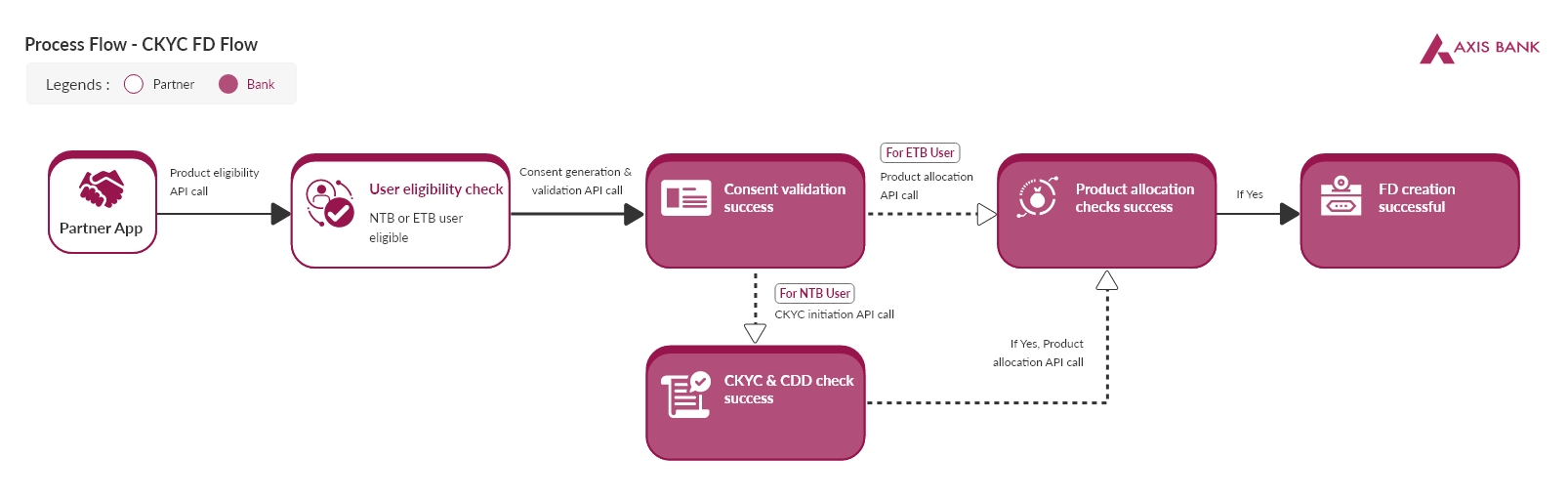

The CKYC Product APIs are used to open instant Fixed Deposit from a third party mobile application / websites for NTB customers using CKYC ID. It is a complete seamless digital onboarding journey where few API calls and required for opening instant Fixed Deposits from partner Mobile Apps/ Websites. The entire journey is divided into 5 stages viz - Product Eligibility, Customer Consent, KYC checks (CKYC for NTB & KYC checks for ETB), CDD (done internally without Partner Intervention) and Product Creation/Allocation.

Use of CKYC data for KYC process for full KYC account.

Customer Consent to download data from CKYC repository.

Robust Validations & CDD basis 3 level check. Data from CKYC matched for continuity and consistency.

No physical visit required. Complete STP Process with complete adherence to compliance and policy.

Aadhar redaction & document verification legs for redacting Aadhar documents downloaded from CKYC and checking the correctness of documents downloaded from CKYC repository.

The entire framework is API based. These APIs can be used by the approved partners within their platform ecosystem for an enhanced onboarding experience.

End to End journey completed within 2 Mins.

Post Facto manual scrutiny process

CKYC - FD

-

This generic API is used to retrieve the nearest Branch details using the PIN code.

-

This API is used to retrieve the list of states and cities with their respective codes.

-

This API is provides the FD balance as on current date and part of Returning Journey.

-

This is a Consent generation API which triggers OTP to the users mobile during returning journey.

-

This is the Product Creation API which is used to create FD basis the details shared by the Partner.

-

This API is used to send FD Advice to users registered emails address.

-

API to check the amount to be received at the end of the FD tenure.